Kenya Strengthens Financial Integrity as President Ruto Signs Landmark Anti-Money Laundering Bill Into Law

President William Ruto has signed into law a crucial Anti-Money Laundering Bill to tighten financial oversight and curb illicit cash flows. The new law amends ten key Acts to meet international compliance standards and remove Kenya from the FATF grey list. He also approved the Insurance Professionals Bill to enhance professionalism and accountability in the insurance sector.

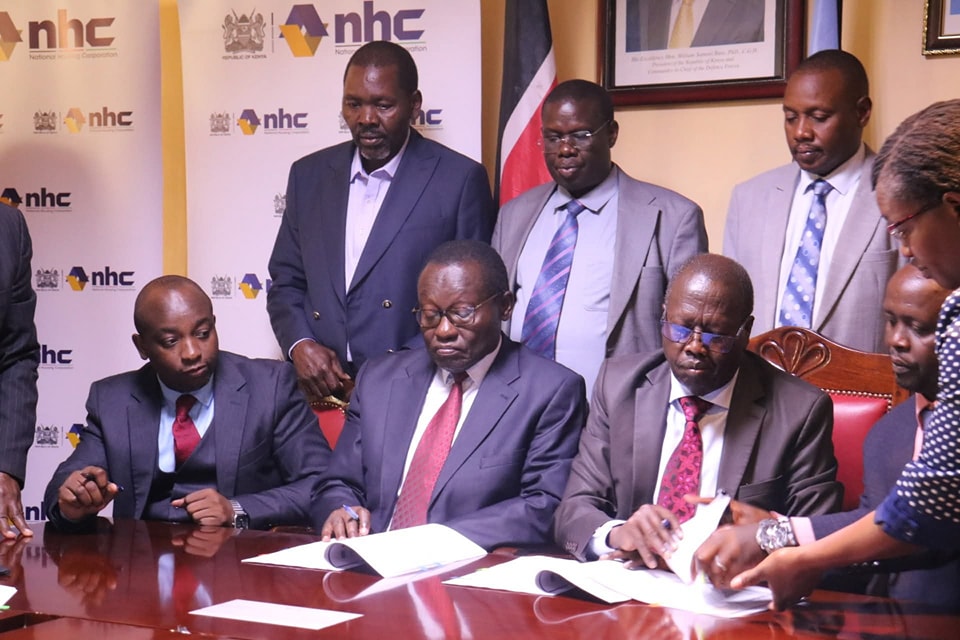

President William Ruto has signed into law the much-anticipated Anti-Money Laundering and Combating of Terrorism Financing Laws (Amendment) Bill, 2025—a significant legislative milestone aimed at enhancing Kenya’s financial integrity and cracking down on illicit financial activities. The move marks a bold step in aligning Kenya with international standards on transparency and accountability in financial transactions.

The Bill, sponsored by National Assembly Majority Leader Kimani Ichung’wah, addresses critical loopholes that have long enabled money laundering and the illegal movement of funds through questionable property dealings and shell companies. By amending ten key Acts of Parliament, the new law seeks to correct technical compliance deficiencies previously flagged by the Eastern and Southern Africa Anti-Money Laundering Group (ESAAMLG) and the Financial Action Task Force (FATF), the global financial crime watchdog.

Among the laws affected by the amendments are the Proceeds of Crime and Anti-Money Laundering Act, the Prevention of Terrorism Act, and the Betting, Lotteries and Gaming Act. Other amended statutes include those governing retirement benefits, mining operations, cooperative societies (SACCOs), public accountancy, real estate agency, public secretaries, and non-profit organizations.

This comprehensive legislative reform comes at a crucial time. In 2024, Kenya was grey-listed by the FATF for failing to effectively address financial crimes, especially money laundering. One of the major concerns was the lack of strategic prosecution and enforcement mechanisms. The FATF also called for better use of financial intelligence information and more stringent oversight of NGOs and not-for-profit organizations, to prevent them from being used as conduits for laundering proceeds of crime or financing terrorism.

By signing the Bill into law, President Ruto has demonstrated the government’s commitment to not only meeting but exceeding global standards in combating economic crimes. It also strengthens Kenya’s position as a reliable and transparent financial hub in the region.

In addition to the anti-money laundering law, President Ruto also enacted the Insurance Professionals Bill (National Assembly Bills No. 13 of 2024), aimed at boosting professionalism and regulation in Kenya’s insurance sector. The Bill, tabled by Molo MP Kuria Kimani, who also chairs the National Assembly Finance Committee, is expected to bring about a new era of ethical and professional standards within the industry.

The Insurance Professionals Bill empowers the Insurance Institute of Kenya (IIK) to act as the principal regulatory body for insurance professionals. Under this framework, IIK will oversee the conduct of its members and ensure compliance with high standards of service delivery. The Bill also establishes the Insurance Professionals Examinations Board, which will be tasked with conducting examinations and certifications to ensure that only qualified individuals serve in the industry.

Additionally, a Disciplinary Committee has been constituted under the new law to investigate cases of professional misconduct. The committee will submit findings and recommendations to the IIK’s Registration Committee, which will be responsible for implementing necessary actions.

Together, these new laws are seen as a critical boost to Kenya’s economic and financial landscape. Analysts believe the legislation will enhance investor confidence, attract more international partnerships, and close the doors on criminal networks that exploit legal loopholes.

With these reforms, Kenya takes a confident leap forward in the fight against financial crimes and the promotion of a robust, transparent, and accountable financial system. The government’s proactive stance is a welcome signal to both citizens and global stakeholders that Kenya is serious about reforming its financial sector and upholding the rule of law.